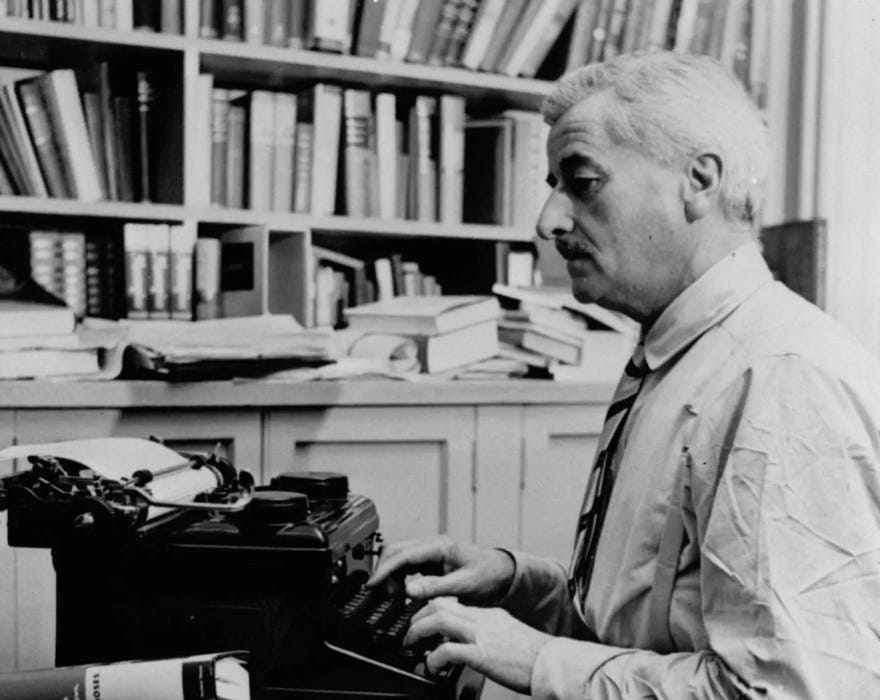

Write-Off What You Know

Some tax tips for writers

Few things are further removed from literary craft than taxes. They’re very dull and confusing and about the last thing artists want to think about. But as we’re approaching tax season I’ve noticed a lot of writers on social media asking basic tax questions, often unaware that they can lower their tax bill a…